五、股票收益模型

大约 2 分钟

1.导入pandas、matplotlib.pyplot和numpy

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

%matplotlib inline

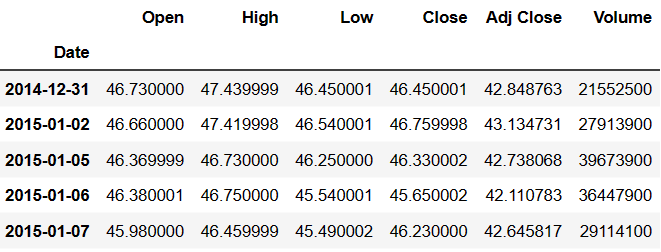

ms = pd.read_csv('data/microsoft.csv',index_col=0)

ms.index=pd.to_datetime(ms.index)

ms.head()

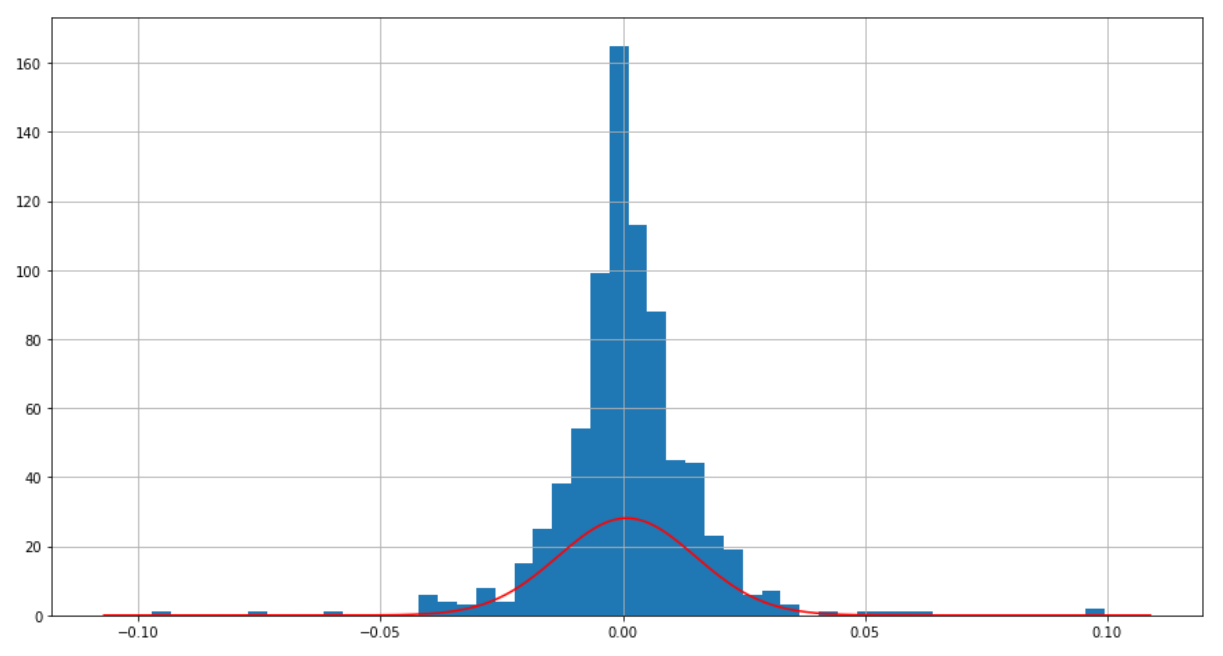

2.Log收益分布

# let play around with ms data by calculating the log daily return

ms['LogReturn'] = np.log(ms['Close']).shift(-1) - np.log(ms['Close'])

# Plot a histogram to show the distribution of log return of Microsoft's stock.

# You can see it is very close to a normal distribution

from scipy.stats import norm

mu = ms['LogReturn'].mean()

sigma = ms['LogReturn'].std(ddof=1)

density = pd.DataFrame()

density['x'] = np.arange(ms['LogReturn'].min()-0.01, ms['LogReturn'].max()+0.01, 0.001)

density['pdf'] = norm.pdf(density['x'], mu, sigma)

ms['LogReturn'].hist(bins=50, figsize=(15, 8))

plt.plot(density['x'], density['pdf'], color='red')

plt.show()

3.计算股票价格在一天内下跌超过一定百分比的概率

# probability that the stock price of microsoft will drop over 5% in a day

prob_return1 = norm.cdf(-0.05, mu, sigma)

print('The Probability is ', prob_return1)The Probability is 0.000171184826087

# Now is your turn, calculate the probability that the stock price of microsoft will drop over 10% in a day

prob_return1 = norm.cdf(-0.10, mu, sigma)

print('The Probability is ', prob_return1)Expected Output: The Probability is 6.05677563486e-13

4.计算股票价格在一年内下跌超过一定百分比的概率

# drop over 40% in 220 days

mu220 = 220*mu

sigma220 = (220**0.5) * sigma

print('The probability of dropping over 40% in 220 days is ', norm.cdf(-0.4, mu220, sigma220))The probability of dropping over 40% in 220 days is 0.00291236331333

# drop over 20% in 220 days

mu220 = 220*mu

sigma220 = (220**0.5) * sigma

drop20 = None

print('The probability of dropping over 20% in 220 days is ', drop20)Expected Output: The probability of dropping over 20% in 220 days is 0.0353523772749

5.计算风险值(VaR)

# Value at risk(VaR)

VaR = norm.ppf(0.05, mu, sigma)

print('Single day value at risk ', VaR)Single day value at risk -0.0225233624071

# Quatile

# 5% quantile

print('5% quantile ', norm.ppf(0.05, mu, sigma))

# 95% quantile

print('95% quantile ', norm.ppf(0.95, mu, sigma))5% quantile -0.0225233624071

95% quantile 0.0241638253793

# This is your turn to calcuate the 25% and 75% Quantile of the return

# 25% quantile

q25 = norm.ppf(0.25, mu, sigma)

print('25% quantile ', q25)

# 75% quantile

q75 = norm.ppf(0.75, mu, sigma)

print('75% quantile ', q75)Expected Output: 25% quantile -0.00875205783841 75% quantile 0.0103925208107