十二、多元线性回归模型

大约 2 分钟

让我们以不同股票市场的历史数据为基础,模拟构建SPY交易模型的过程

import pandas as pd

import statsmodels.formula.api as smf

import numpy as np

import matplotlib.pyplot as plt

%matplotlib inline

import warnings

warnings.filterwarnings("ignore")

# import all stock market data into DataFrame

aord = pd.read_csv('data/indice/ALLOrdinary.csv')

nikkei = pd.read_csv('data/indice/Nikkei225.csv')

hsi = pd.read_csv('data/indice/HSI.csv')

daxi = pd.read_csv('data/indice/DAXI.csv')

cac40 = pd.read_csv('data/indice/CAC40.csv')

sp500 = pd.read_csv('data/indice/SP500.csv')

dji = pd.read_csv('data/indice/DJI.csv')

nasdaq = pd.read_csv('data/indice/nasdaq_composite.csv')

spy = pd.read_csv('data/indice/SPY.csv')

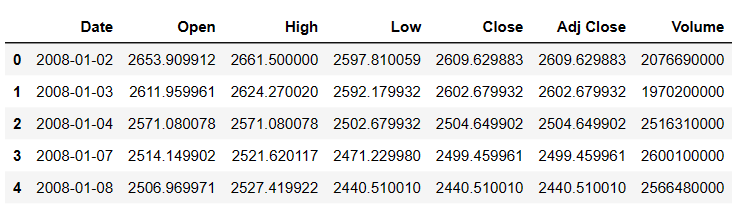

nasdaq.head()

Step 1: Data Munging

# Due to the timezone issues, we extract and calculate appropriate stock market data for analysis

# Indicepanel is the DataFrame of our trading model

indicepanel=pd.DataFrame(index=spy.index)

indicepanel['spy']=spy['Open'].shift(-1)-spy['Open']

indicepanel['spy_lag1']=indicepanel['spy'].shift(1)

indicepanel['sp500']=sp500["Open"]-sp500['Open'].shift(1)

indicepanel['nasdaq']=nasdaq['Open']-nasdaq['Open'].shift(1)

indicepanel['dji']=dji['Open']-dji['Open'].shift(1)

indicepanel['cac40']=cac40['Open']-cac40['Open'].shift(1)

indicepanel['daxi']=daxi['Open']-daxi['Open'].shift(1)

indicepanel['aord']=aord['Close']-aord['Open']

indicepanel['hsi']=hsi['Close']-hsi['Open']

indicepanel['nikkei']=nikkei['Close']-nikkei['Open']

indicepanel['Price']=spy['Open']

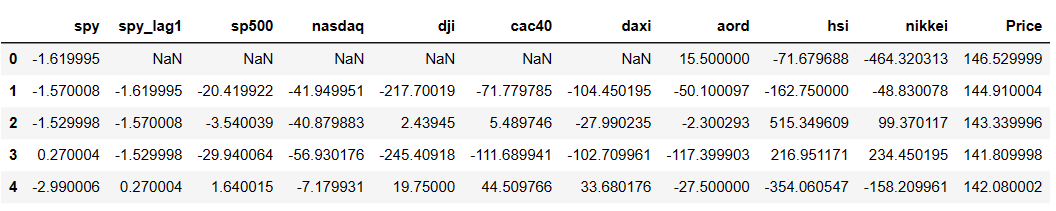

indicepanel.head()

# Lets check whether do we have NaN values in indicepanel

indicepanel.isnull().sum()spy 1

spy_lag1 1

sp500 1

nasdaq 1

dji 1

cac40 3

daxi 11

aord 2

hsi 57

nikkei 57

Price 0

dtype: int64

# We can use method 'fillna()' from dataframe to forward filling the Nan values

# Then we can drop the reminding Nan values

indicepanel = indicepanel.fillna(method='ffill')

indicepanel = indicepanel.dropna()

# Lets check whether do we have Nan values in indicepanel now

indicepanel.isnull().sum()spy 0

spy_lag1 0

sp500 0

nasdaq 0

dji 0

cac40 0

daxi 0

aord 0

hsi 0

nikkei 0

Price 0

dtype: int64

# save this indicepanel for part 4.5

path_save = 'data/indice/indicepanel.csv'

indicepanel.to_csv(path_save)

print(indicepanel.shape)(2678, 11)

Step 2: Data Spliting

#split the data into (1)train set and (2)test set

Train = indicepanel.iloc[-2000:-1000, :]

Test = indicepanel.iloc[-1000:, :]

print(Train.shape, Test.shape)(1000, 11) (1000, 11)

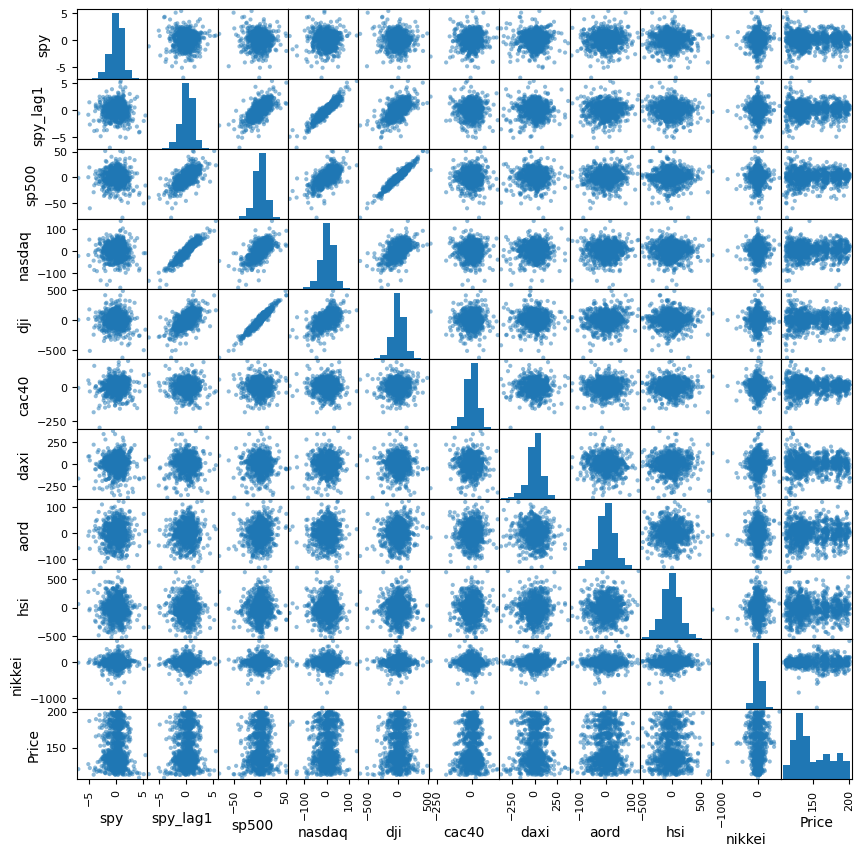

Step 3: Explore the train data set

# Generate scatter matrix among all stock markets (and the price of SPY) to observe the association

from pandas.plotting import scatter_matrix

sm = scatter_matrix(Train, figsize=(10, 10))

Step 4: Check the correlation of each index between spy

# Find the indice with largest correlation

corr_array = Train.iloc[:, :-1].corr()['spy']

print(corr_array)spy 1.000000

spy_lag1 -0.011623

sp500 -0.018632

nasdaq 0.012333

dji -0.037097

cac40 0.076886

daxi 0.019410

aord 0.048200

hsi -0.038361

nikkei 0.035379

Name: spy, dtype: float64

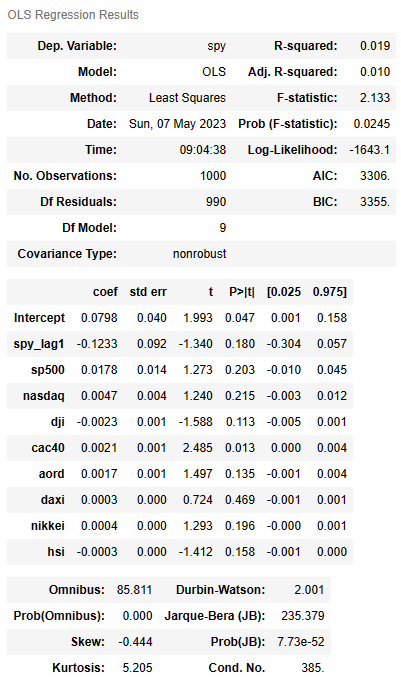

formula = 'spy~spy_lag1+sp500+nasdaq+dji+cac40+aord+daxi+nikkei+hsi'

lm = smf.ols(formula=formula, data=Train).fit()

lm.summary()

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

Step 5: Make prediction

Train['PredictedY'] = lm.predict(Train)

Test['PredictedY'] = lm.predict(Test)

plt.scatter(Train['spy'], Train['PredictedY'])<matplotlib.collections.PathCollection at 0x210353c2a50>

Step 6: Model evaluation - Statistical standard

We can measure the performance of our model using some statistical metrics - RMSE, Adjusted 𝑅2�2

# RMSE - Root Mean Squared Error, Adjusted R^2

def adjustedMetric(data, model, model_k, yname):

data['yhat'] = model.predict(data)

SST = ((data[yname] - data[yname].mean())**2).sum()

SSR = ((data['yhat'] - data[yname].mean())**2).sum()

SSE = ((data[yname] - data['yhat'])**2).sum()

r2 = SSR/SST

adjustR2 = 1 - (1-r2)*(data.shape[0] - 1)/(data.shape[0] -model_k -1)

RMSE = (SSE/(data.shape[0] -model_k -1))**0.5

return adjustR2, RMSE

def assessTable(test, train, model, model_k, yname):

r2test, RMSEtest = adjustedMetric(test, model, model_k, yname)

r2train, RMSEtrain = adjustedMetric(train, model, model_k, yname)

assessment = pd.DataFrame(index=['R2', 'RMSE'], columns=['Train', 'Test'])

assessment['Train'] = [r2train, RMSEtrain]

assessment['Test'] = [r2test, RMSEtest]

return assessment

# Get the assement table fo our model

assessTable(Test, Train, lm, 9, 'spy')